Is lithium battery safe?

The Current Situation and Prospects of the Lithium Battery Industry

• Demand Surge: Since the third quarter of 2025, the explosive growth of the energy storage market has led to a rapid increase in the demand for lithium battery materials. The prices of lithium hexafluorophosphate, lithium iron phosphate, and lithium carbonate have risen significantly. A lithium carbonate production enterprise in Sichuan reported that even with full capacity utilization, the demand could not be met, and long-term contract customers even lived near the company to wait for delivery.

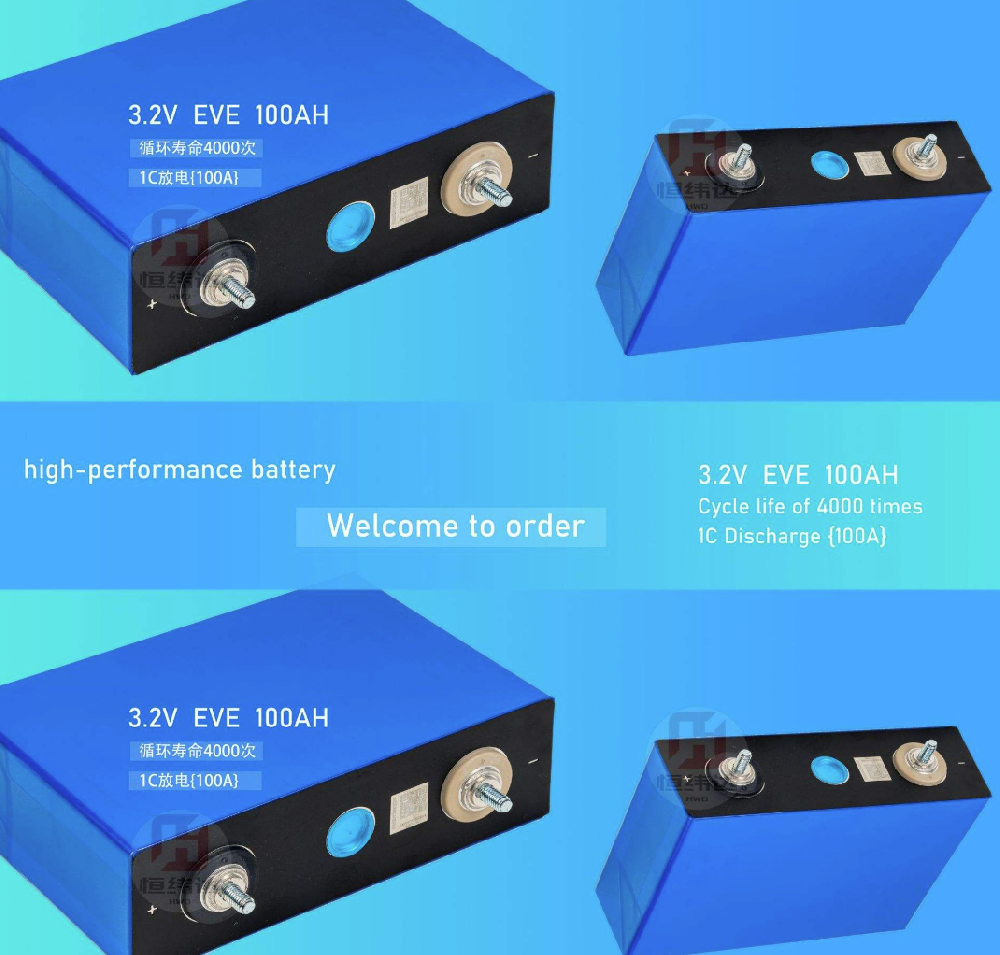

• Phosphate Iron Battery: The installed capacity of phosphate iron batteries in new energy storage exceeds 97%, occupying an absolute dominant position.

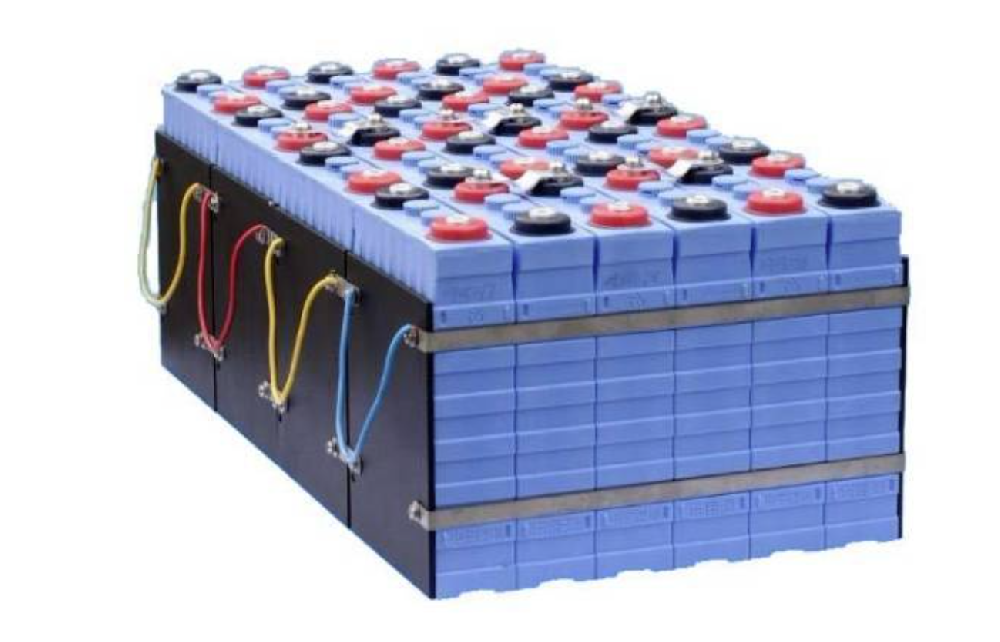

• Solid-State Battery Progress: The commercialization of semi-solid batteries has accelerated. On December 3, 2025, a 200,000-kilowatt/800,000-kilowatt-hour semi-solid energy storage power station in Wuhai, Inner Mongolia, was successfully connected to the grid. This is the largest semi-solid lithium battery grid-side independent new energy storage project in China; automakers such as Mercedes-Benz have completed real vehicle tests for solid-state batteries, with a range exceeding 1,200 kilometers. TrendForce predicts that the global demand for solid-state batteries (including semi-solid) will exceed 206 GWh in 2030 and reach over 740 GWh in 2035.

Supply Chain and Investment Opportunities

• Profit Transmission: CICC believes that the excess profits from the downstream investment and operation of energy storage will be transferred to the materials, batteries, and integration stages through price increases in the middle and upstream. There are opportunities for a simultaneous increase in quantity and profit in the lithium battery industry, and the materials (6F, lithium iron phosphate, negative electrode, separator) and battery segments are favored.

Demand Growth: CICC has raised the domestic new energy storage installed capacity for 2026 to double, expecting that the total demand for lithium batteries in 2023 will exceed 2700 GWh, with a year-on-year growth rate of over 30%; by 2030, the shipment volume of energy storage lithium batteries in China will exceed 1400 GWh.

• Technical Direction: Energy storage battery products will develop in the directions of large capacity, large-scale, easy recycling, and digitalization.